💡 Optimist's Edge: How to get a handle on the economy in 2023

💡 With digital tools, you can get a detailed overview of your finances.

Share this story!

📉 What people think

The economy is in a state of flux. The pandemic was followed by an uncertain time, and after that came war, inflation, and an emerging energy crisis with high electricity prices for both households and businesses.

But what do people think?

7 out of 10 believe that prices will continue to rise in 2023, according to a recent survey conducted by the research company Ipsos in collaboration with the World Economic Forum. And 8 out of 10 believe that real incomes will fall.

📈 Here are the facts

It is therefore a rather difficult financial situation that many find themselves in when it is time to welcome the new year. But it is possible to find ways forward that allow one's own situation to be strengthened. Basically, it's about getting a better handle on what exactly you can do.

Everyone has their individual life situation and conditions to take into account. But more knowledge regarding both the small and large perspective is necessary to navigate in the best way in economically turbulent times. There is much you can do yourself to improve your understanding of your own personal finances.

💡 Optimist's Edge

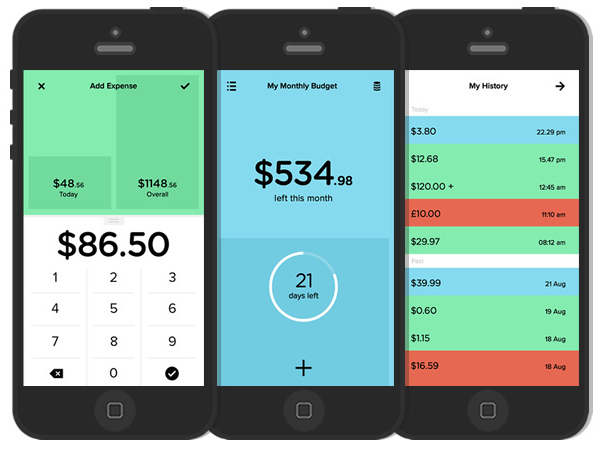

💡 With digital tools, you can get a detailed overview of your finances.

Some already use a number of services today to get a better handle on income and expenses as well as savings, but this is a field that is growing quickly and new aids are popping up like shoots out of the ground all the time.

👇 This is how you get the Optimist's Edge

Find the right tool. Perhaps a few days of Christmas leave us a good opportunity to browse through what is available to use and what suits you. Here are some tips.

A popular app is Pennies.

"Pennies keeps it super simple, so budgeting doesn’t have to be a chore. It’s got everything you need to track where your money is going and how much you have left," writes MoneysMyLife.

- Anyfin is a refinancing company, developed by former employees from Klarna and Spotify, which collects information relating to your current loans and credits and offers help to lower your loan expenses. Available in Sweden, Germany, Finland, and Norway.

- Are you going to teach the seven-year-old about private economics and the importance of saving? Check out Gimi. Here you can pay for chores and weekly allowance while the child learns more about numbers and finances.

- Here is a list of the best personal finance apps. Top of the list: Mint.

- And here is a list from NerdWallet of the eight best budget apps. Again Mint tops the list.

- Automate. The step from getting an overview of the economy to getting suggestions on how you can act on the facts will be increasingly influenced by AI in the future. Wired has an interesting article about it.

Psst! Don't miss Sweden's thriftiest person - or as some call him, "stingiest" - tips on saving in everyday life. It's about bargains, investments in gadgets, late bookings, and planning.

"In the best of worlds, times of crisis and economic unrest can lead to more and more people gaining better knowledge of economics, both on a macro and individual level. This provides many benefits in the long term" says Günther Mårder, Sweden's thriftiest person.

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.