💡 Optimist's Edge: Larger emissions mean greater opportunities

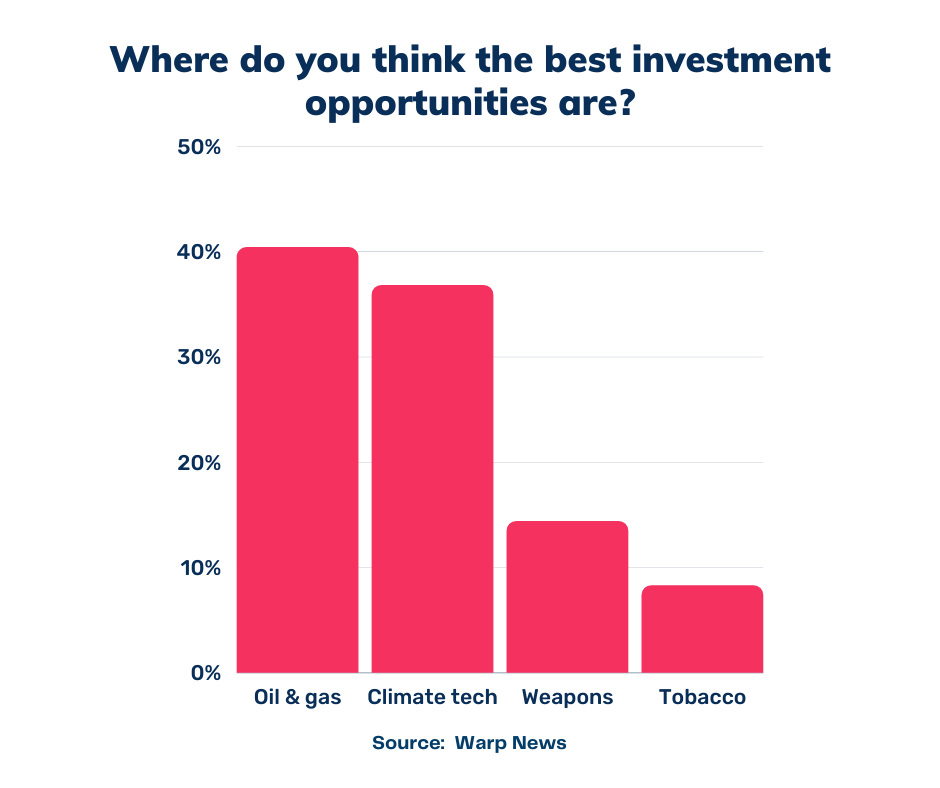

Investing in oil and gas will not pay off as much in the future. Still, people, in general, believe so. As the world shifts to more non-fossil energy sources, it is important to know which companies and areas are best to invest in.

Share this story!

📈 What people think

A majority believe that oil, gas, weapons, and tobacco are better investments than climate technology.

📈 Here are the facts

Of course, investments depend on how long-term your investments are intended to be. Given Vladimir Putin's invasion of Ukraine, the short-term investor can make more money on oil and weapons than climate technology.

In the slightly longer term, 10-15 years, most indications are that those who invest in oil and gas will see a significantly slower growth rate than those who invest in the climate area.

The world needs to transition from fossil fuels to non-fossil fuels, and that transition has begun.

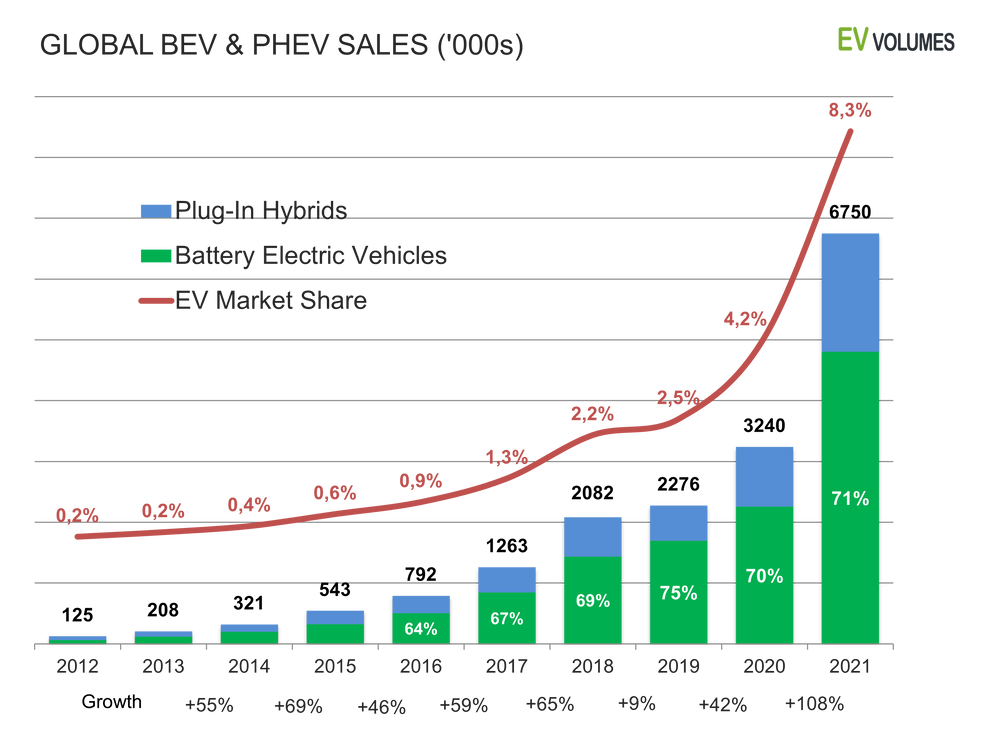

Electric cars show where the world is headed

The most unmistakable sign is electric cars. They make up just over one percent of all vehicles on the roads, but sales have doubled every two years in recent years. Last year it went even faster; sales increased by 108 percent.

In 10-15 years, all new cars sold will be non-fossil cars. It will hit the oil price hard.

Read more in this previous Optimist's Edge article:

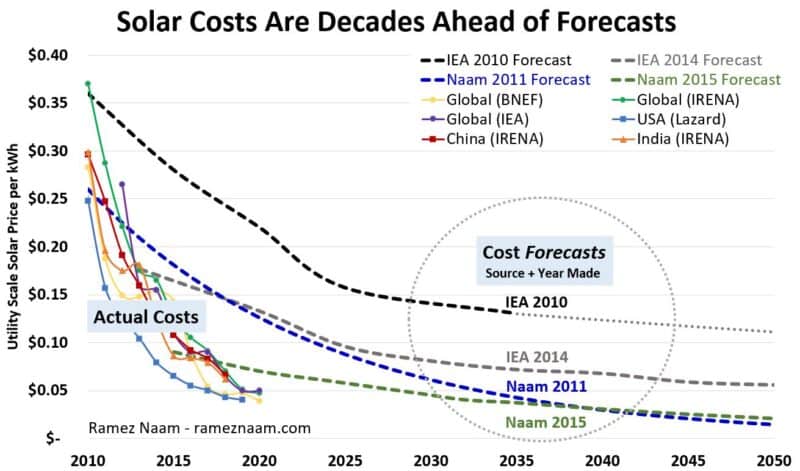

The price of solar energy is dropping rapidly

Another example is the price of solar energy. We are entering the third phase of renewable energy.

In the third phase, it's cheaper to build new renewables than to continue operating existing coal and gas production.

Read more in this article:

💡 Optimist's Edge

Some of the world's most successful companies will be those that successfully replace fossil technology.

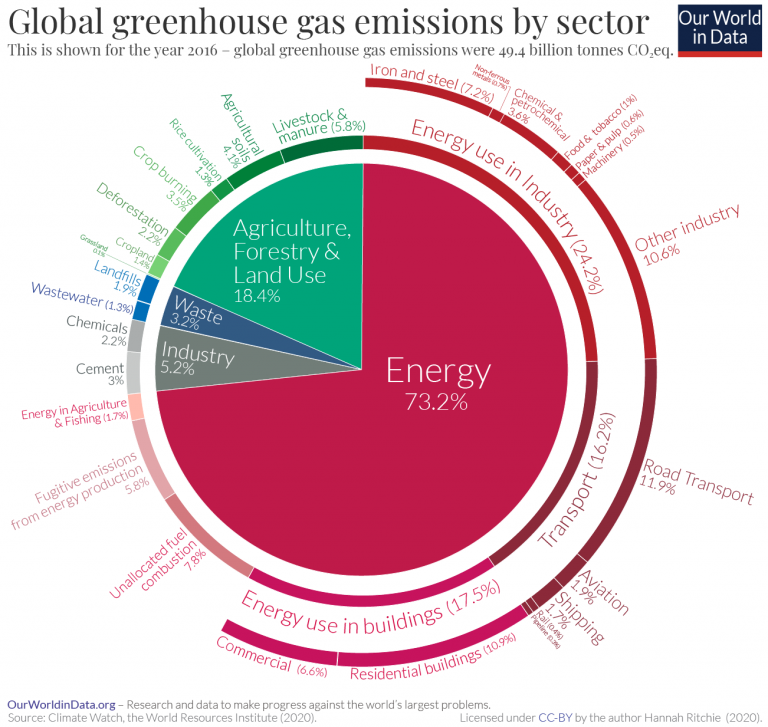

💡 The larger the emissions are, the greater the possibilities will be. Choose which climate emissions you think will be most profitable to replace. Then invest in or start companies that solve that problem.

Look at this compilation of global climate emissions.

Energy accounts for 73 percent, of which industry accounts for 24 percent, of which iron and steel 7 percent. If you think steel is an exciting possibility, you can, for example, invest your money in H2 Green Steel.

If you think that transport is a better area (16 percent) and want to invest in electric cars (12 percent), then, of course, you have Tesla, but also many other new and old car companies to choose between. Battery manufacturer Northvolt is also an alternative, or Cling Systems, which creates a market platform for used electric car batteries.

If you see greater opportunities in the air, you may want to buy shares in the electric aircraft manufacturer Heart Aerospace.

Maybe energy is not your thing; you see a more lucrative business in forestry and agriculture (18 percent) and therein, more specifically, the meat industry (6 percent.) In that case, you can invest a penny in Petgood, which sells dog food made from insects instead of meat.

Of course, you can choose based on other criteria than where you think the most profitable companies are. It could be in the areas that you think do the most good, or for some other reason. But everywhere you go, you will come across companies that are active in solving climate change.

👇 How to get the Optimist's Edge

- Choose which emission field you think has the most significant potential or feel most strongly for.

- Examine which startups and companies are trying to solve the emissions in that field.

- If you find interesting startups and companies there, you can buy shares in them.

- You can also become an early adopter, spread their news, and help them with feedback.

- Or why not seek a career in one of these companies.

- If you can't find any startups or companies that you think are good enough, why not start your own company that solves the problem.

Find the right company.

Impact Dealroom has an extensive database of impact startups. You can search for startups based on several criteria and, for example, find companies that work with vertical cultivations, fusion power, or green steel.

Climate Tech VC has a free newsletter on climate investments.

How to invest in green companies (without having millions to invest)

- Buy active EFTs. You can buy these funds on the stock exchange, and there are several with a green focus. For example, Engine No 1. Read more here about green EFTs.

- You can buy shares yourself based on companies listed in green indices, such as the EIP Climate Tech Index.

- If you have an income of at least $ 200,000 per year or at least $ 1 million in assets, you can start investing in so-called rolling funds or syndicates on AngelList.

This is not advice to invest in any specific companies or funds. Always do your own research.

❓ Want more? Discuss with others in our forum!

Please share your ideas and thoughts with other Premium Supporters in our Facebook group. Maybe you will find your future business partner or investor.

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.