💡 Optimist's Edge: When cash no longer is king – this is what you need to know about cashless societies

Societies are going cashless, and there are a lot of benefits to this development. The cashless society is most likely not defined by opportunistic hacking crimes but by smoother payments, and a more connected world.

Share this story!

Summary

📉 What people believe

People tend to identify risks rather than opportunities. This is also the case with the shift from physical money to digital.

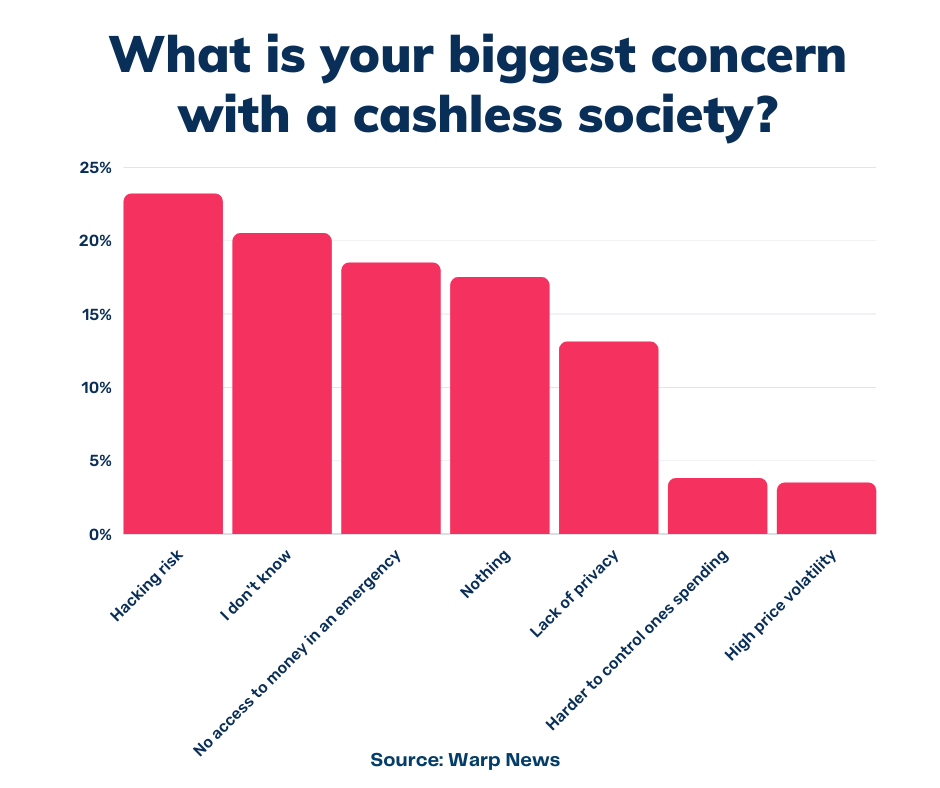

When people are asked what their biggest concern is with money turning digital, most answer “hacking risks.”

People are also fond of the feeling of cash, which makes them feel “secure.”

📈 Here are the facts

While shops and venues also in countries that have come far on the journey to cashlessness still accept payments in cash, the customers are the ones who choose other payment forms.

The problems associated with cash are numerous: it costs a lot to handle, some types of crime are higher with cash in circulation – not to mention that it soon will be outdated.

However, yes, there are some challenges that come with digital money. Security is one of them, but as societies are going cashless, fixing these problems will be a priority for companies and governments.

💡 Optimist’s Edge

Instead of dwelling on the risks and getting lost in the maze of thinking about cybercrime and personal integrity threats, imagine there is a way to enhance security whilst going digital.

Could, in fact, a cashless country become less of a target for cybercrimes if the right policies and security measures were to be developed and administered?

The cashless world will offer new business models and opportunities as well as a safe and smooth money system.

👇 How to get the Optimist’s Edge

While being prepared is always beneficial, it is essential in a system shift. Educating yourself about previous similar shifts and analyzing where the new business opportunities will evolve is a great start.

More concretely, following certain actors and businesses will give you a heads up when it comes to finding a new career path or interesting investment entries.

Introduce ”tech coach” and “digital wallet” into your vocabulary – so that you can become a force in onboarding those who need to be enlightened.

📉 What people believe

Many people do not know why they are suspicious of the idea of a cashless society, yet they are.

When asked about what the biggest concern with a cashless society is, 24 percent answer “hacking risk,” followed by “don’t know” 19,7 percent, and “no access to money in an emergency” 18,5 percent, according to Warp News' Survey.

The hacking risk is, of course, a valid reason to doubt the stability of a system that all in all is digital. Cybercrime, in general, is on the rise, creating havoc for lots of companies and people around the world daily. It is expected to cost the world more than 10 trillion dollars annually by 2025.

Moreover, people tend to value cash in the physical sense. A study from 2018 in Britain revealed that 97 percent keep cash on them, and almost half of the respondents meant it “provides a peace of mind.”

Britain, like many other countries, is however continuously taking steps towards a less cash-driven society. According to a report from Money Transfers, the U.K will be cashless in 2026. Some experts argue that Sweden will reach this in 2023 already.

Still, both Sweden and the U.K, which have come far in this process, have less support for digital money among its citizens than countries that are more prone to keeping physical money.

In the Money Transfer report from June this year, people living in India, Malaysia, United Arab Emirates, Indonesia, Vietnam top the lists of citizens who most strongly favor the idea of a cashless society.

There are, in addition to the cybersecurity aspect, several other reasons for favoring physical cash in certain situations, such as the loss of cash might lead to less interaction between individuals, it can be more difficult to budget – especially for some groups, and it could increase spending habits when the money used is “invisible.”. But as it usually goes, solving one problem creates new ones, but generally, the improvements are weighing heavier. And this is the case when it comes to a cashless world too.

📈 Here are the facts

Despite people's worries, a lot of us are already living in (almost) cashless societies. These societies also tend to belong to some of the most well-functioning countries in the world.

Sweden is a forerunner when it comes to cashlessness. Within the next few years, Sweden will become truly cashless.

Already today, many shops and restaurants do no longer accept cash. Nor do busses or other transportations. Only a few percent (ranging between two and nine) of all transactions in Sweden are made using cash. Most transactions are conducted by mobile identification, "Mobilt bank ID", where a person uses his/her identity number to sign bank payments. Many Swedes also use an app, Swish, for small instant payments with friends or acquaintances instead of exchanging bills and coins.

The introduction of digital currency, in Sweden known as “e-krona,” is under investigation. Former politician Anna Kinberg-Batra is heading an inquiry on the digital currency. By November 2022, the inquiry will present its results. There are also “sharp” ongoing studies of how e-krona will work in the economic systems, lead by the Swedish central bank, "Riksbanken."

The development in Sweden is largely driven by the people rather than politicians; customers' use of cash is going down day by day, even if there is an age gap.

Cash costs a lot. The costs for handling cash are high. According to researchers Niklas Arvidsson and Jonas Hedman, the sellers in Sweden pay 3.9 percent of each sale on cash handling.

Benefits associated with letting go of cash are several:

Crime rates are expected to shrink, as there is no physical money to steal. Money laundering also becomes more difficult when there are digital trails available. The time spent with handling and storing paper money could be used differently, and the costs that follow are reduced. Also, currency exchange will become easier.

Sweden used to have trouble handling cash-in-transit robberies just a decade ago; since then this type of crime had plunged and almost vanished in all, partly because the use of cash has decreased during the last years.

Countries around the world are taking the leap

Other countries, ranging from the small island of the Bahamas to the giant economy of China, have also come far with developing digital currencies.

India is another example. India is working towards a shift to a digital monetary system. A local journalist explains the country’s development in the context of “point of no return.” Monika Halan, the editor of the Delhi-based financial newspaper Mint, is interviewed by the BBC and explains how the Indian government is motivated to make a shift into a cashless society.

"I really do believe that once the technology genie is out of the bottle, how do you put it back?"

When superpowers as China and India are taking the system shift from physical to digital seriously, it is a strong signal for the rest of us to get prepared.

And if the above reasons were not enough, the pandemic is pushing the banknotes and coins away due to sheer hygiene factors.

💡 The Optimist’s Edge

Almost all of the previously mentioned and unmentioned reasons for doubting the digital development towards cashless are possible to address. In fact, they all constitute interesting cases for driven individuals and entrepreneurs. Today’s problems could, in fact, become tomorrows’ business opportunities.

While modern and stable countries are making use of the technological possibilities, people are also adapting quickly, and the surge for even more secure and consumer-friendly tools will continue to grow.

Everyone knows that it takes time to change values, yet as soon as a new norm is in place, it is often accompanied by a sense of “no looking back.”

Those who both understand the challenges with the shift taking place and who also have the knowledge, expertise, and innovativeness to address the same will have an advantage. If you are choosing an education or work path, reflect on the impact a fully digital monetary system will have on different parts of the society you live in – as well as the world as a whole. What competencies and knowledge will be necessary for this project to succeed?

Instead of dwelling on the risks which follow with a cashless state, analyze what inventions, methods, and businesses will be vital for it to succeed. Could, in fact, a cashless country with time even become less of a target for cybercrimes if the right policies and security measures were to be developed and administered?

As much as people want more smooth payment options, they do not want more surveillance. Figuring out how to protect the personal integrity of consumers will be vital.

All major technology shifts are easier for certain groups of the population and thus more challenging for others. Including the latter group will be important – and lucrative.

👇 How to get the Optimist’s Edge

With security issues being a central concern for all involved ranging from governments, companies, banks to individuals, this seems to be a great starting point for anyone who wants to make the most out of the monetary system shift. Data, integrity, and it-security are three core areas that will be essential to master.

Is it possible to construct secure digital environments customized towards the needs of a new digital currency? What other changes are likely to follow with the digital monetary shift? Unexplored business models will be attractive when cash no longer is king.

This is what you need to start doing:

- Follow countries that are breaking new ground, how are the entrepreneurs, citizens, and governments acting and adapting?

- Have a look at successfully established as well as on the rise companies in banking, fintech, and security — both for investments and inspiration in building new structures necessary for the digital shift. But also for career opportunities. Klarna, the Swedish business model which revolutionized online payments, is a great example of a disruptor of the sort that any new shift is in need of.

- Learn more about initiatives that are occupied with solving the new problems related to the new digital economy. Such as, for instance, Crunchfish and Privacy, which develops virtual cards in order to protect privacy in a digital shopping system.

- Get acquainted with tech coaching. A crucial aspect for implementing digital money will be solving how to take on board those who are more resistant to new technology or have difficulties learning and using new tech.

According to Pew Research, many seniors in the US remain largely disconnected from the digital revolution. One-third of adults ages 65 and older never use the internet and less than half, 49 percent, say they lack home broadband services. - Education and coaching will be useful for governments and citizens, not to mention businesses. Yet, more basic tech coaching might become as popular as any other coaching when large groups of people need to adjust quickly. The pandemic revealed some flaws in the present digital systems in Sweden when groups who did not have access to or had installed digital identification properly were left out when reservations for vaccine slots primarily were scheduled digitally.

It's time to embrace digital money and start working on how to tackle the challenges. After all the genie is already halfway out of the bottle...

❓ What more can you do?

Please share more ideas with your fellow Premium Supporters in our Facebook group.

Note: The survey mentioned in the article is done through Google on 500 respondents.

The contents of this article do not constitute financial advice, and we encourage you to do your own extensive research before investing.

Read more

https://www.ncr.com/blogs/banking/cashless-society

https://www.thebalance.com/pros-and-cons-of-moving-to-a-cashless-society-4160702

https://cashessentials.org/the-major-risks-of-a-cashless-society/

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.