🚗 Tesla's unique position beyond the hype

Has the stock market gone crazy or is there substance behind the hype? To value Tesla, one must understand the dramatic change the automotive industry is going through and how Tesla is leading that change.

Share this story!

This is a premium article, part of our content for Premium Supporters, open for everyone thanks to the members' generous contributions.

Tesla's stock has been in a race upwards on the stock exchange and the company recently passed Volkswagen as the world's second most valuable car company. Only Toyota has a higher market capitalization. Volkswagen sold a little more than six million cars in 2019, while Tesla came in at 367,500. Volkswagen sells more cars in a month than Tesla in a year.

The stock exchange has thus gone crazy, again. Or?

"In the short run, the market is a voting machine but in the long run it's a weighing machine," as Benjamin Graham said.

In the short term, the stock exchange determines which companies are popular or unpopular. Courses sometimes go up or down just because they go up or down. But in the long run, it is the company's actual substance that determines value.

Warren Buffett called Graham's book, The Intelligent Investor, "by far the best book on investing ever written."

Let's put Tesla on the weighing machine

I am not a stock analyst and this text does not mean I want to be, but is an attempt to look beyond the hype and describe what the substance of Tesla is, and what is to be weighed in the long term.

Right now (February 2020), the stock exchange's voting machine is in full swing. You don’t need to be a stock analyst to see that there is a lot of hype. Of course, this means that a downward recoil would not be unexpected, but in the long run, there is much that speaks in Tesla's favor.

This text is about Tesla, but it is about more than that. How you, through a broad understanding of the future, can see things before most others do.

Do not take this as investment advice if you are going to buy or sell shares in the company and you should also know that I own a number of Tesla shares, which I purchased in 2016.

The car industry will not only be the car industry

To understand what is happening with Tesla, we must first understand what is happening with the car industry. It is at the beginning of a dramatic change.

The conversion to electricity is almost total. There are some alternatives like hydrogen, but all the car companies seem to agree on abandoning the internal combustion engine.

At the same time, the cars will start to drive themselves. A development that began in the early 2000s with the DARPA competition, which you can read about in this WIP article.

This means that car companies must become software companies, which is fundamentally different from building cars. They also need to learn how to connect vehicles to the internet and continuously improve the software. Not just make a product that you ship off and never see again.

In addition, car companies are probably forced to change their business model in the middle of all this. The trend seems to be towards transport-as-a-service, especially when the cars become self-driving. You will order your transport in an app based on the needs you have for the moment. Sometimes it is an electric scooter, sometimes a large SUV.

The future of the automotive industry seems to be 1) electrification, 2) self-driving (including connected cars), and 3) transport-as-a-service.

Let's see how Tesla is positioned in these three areas.

Tesla leads the electric car revolution

The first argument for Tesla is the most obvious one: They started and now lead the electric car revolution. All other car companies must change and learn how to make electric cars; Tesla doesn't have to.

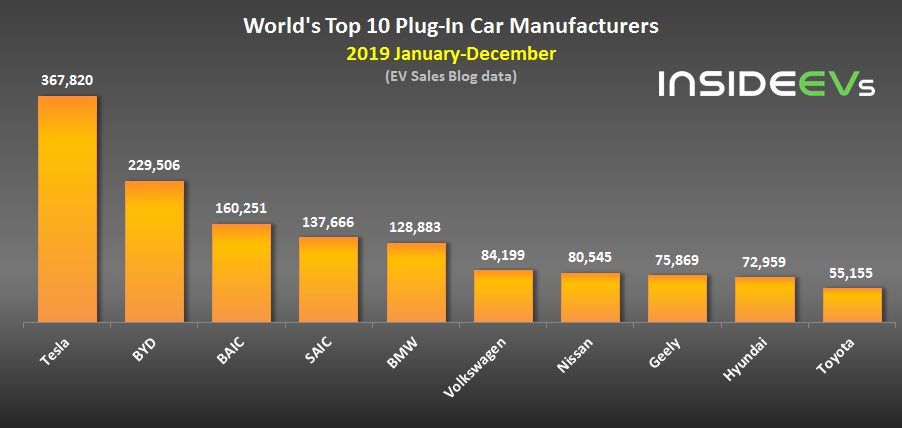

Tesla is dominating EV sales and even if you count the plug-in hybrids, they lead clearly.

Best batteries with the longest range and highest production capacity

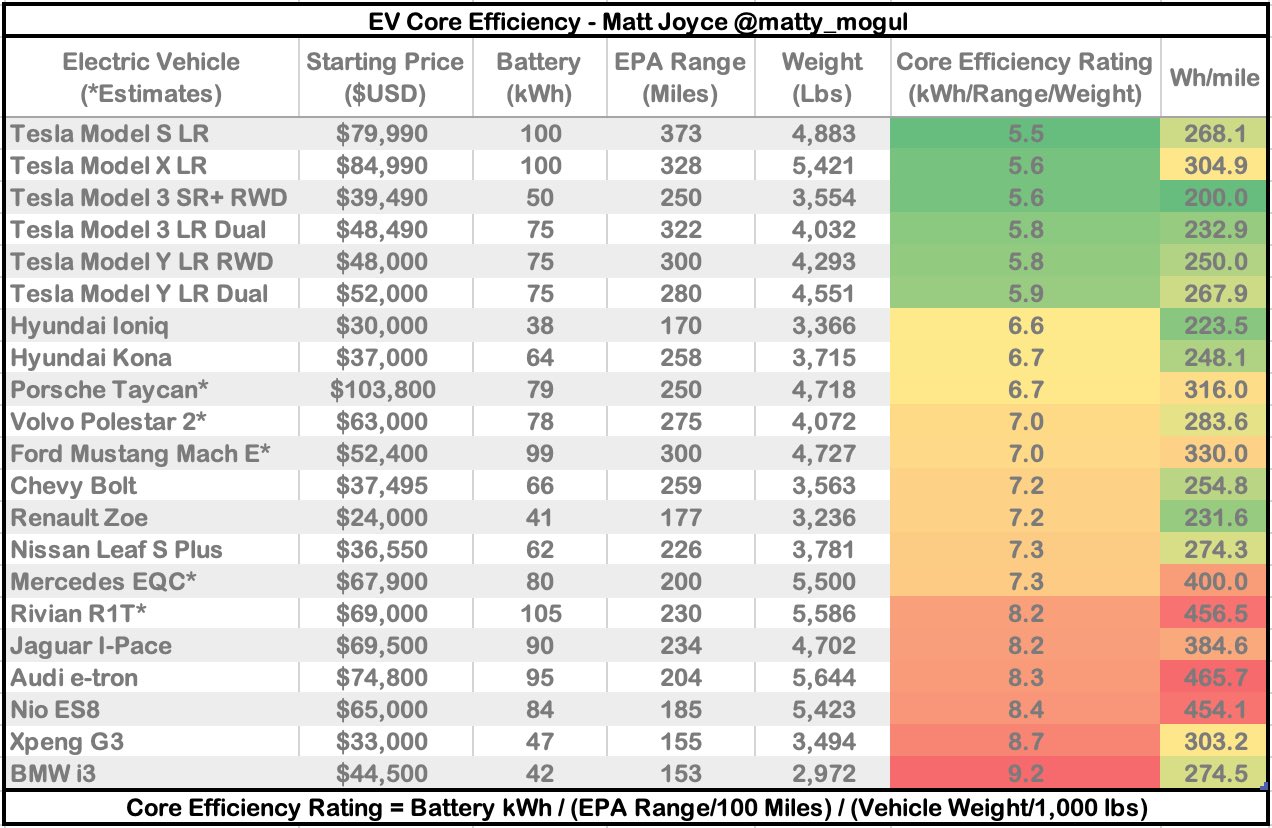

As you can see in the compilation below, Tesla leads when it comes to the efficiency of the cells and distance.

Thanks to the expensive and risky investment in the colossal battery factory, Gigafactory Nevada, they have the batteries needed to scale up over the next few years. Although the availability of batteries is probably the most limiting growth factor for Tesla as well. Other car companies are worse off and the shortage has already led to delays.

Increasing leadership in self-driving

The second major shift in the automotive field, after electric drive, is self-driving. Here, too, Tesla is in the lead. Last year, they launched a self-produced chip specially adapted to handle images, which Tesla cars mainly use to understand the world. The chip is 21 times faster than the second-best on the market.

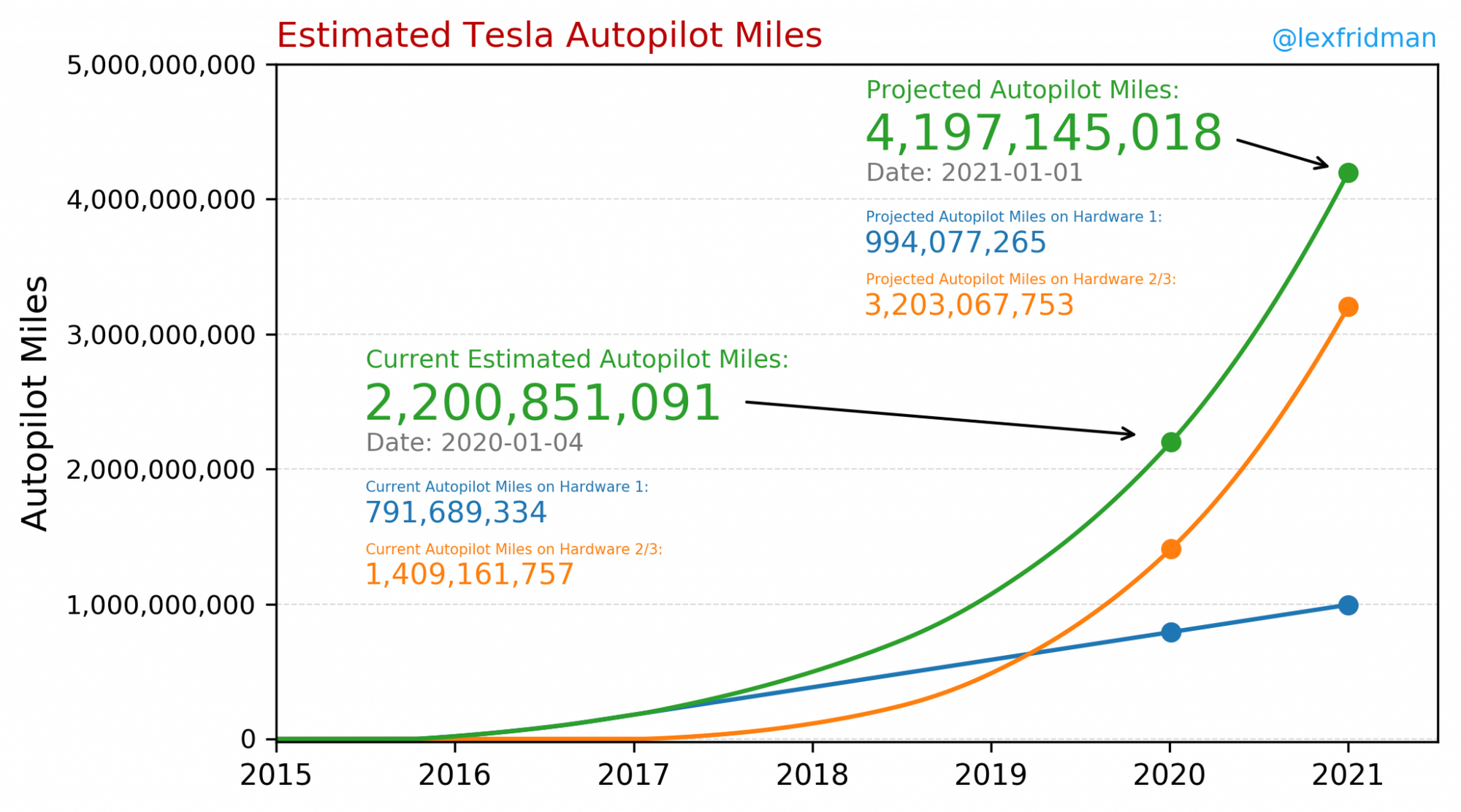

Tesla now has about half a million cars on the roads that have the hardware to drive themselves. As these cars drive, they collect vast amounts of data. The data is uploaded to Tesla and its neural network uses it to continually improve. In early 2020, these cars had driven just over two billion miles with the autopilot. That will at least double within a year.

The number two is probably Google company Waymo. Their cars have driven 20 million miles. Not even a hundredth of what Tesla has driven.

Robot taxi can become a significant source of revenue

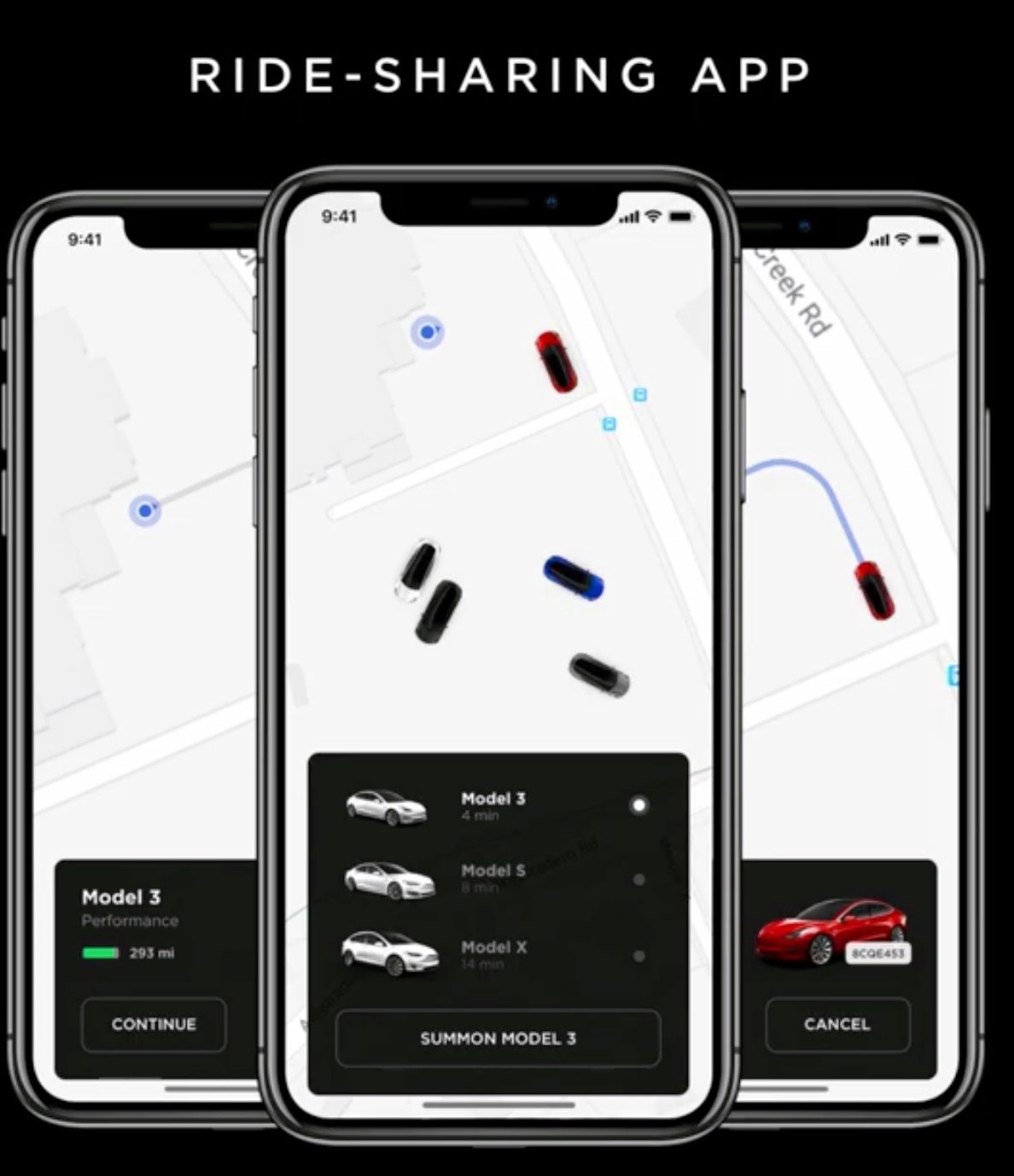

Within a year, Tesla intends to turn on its robot taxi service. You will be able to order a Tesla in an app the same way you order an Uber. But the Tesla cars will not have a driver. Tesla owners will be able to rent out their vehicles in this network and Tesla will also have their cars in the network.

My guess is that this is what investors are most excited about in Tesla's future. The most significant cost in a taxi or an Uber is the driver. Without drivers, the price can be very attractive, and also in a nice car.

Tesla expects a cost of just over $0.10 per mile and the price for the customer of just over $0.60 per mile. Taxis are about $2-2.50 per mile. You don’t need a calculator to understand that it can mean huge revenue.

Elon Musk believes the robot taxi network will be turned on by the end of 2020. If it happens so soon, I guess it will be a variant where the customer may sit in the driver's seat and monitor and be prepared to take over. If fully self-driving robot taxis are rolled out in 2021, 2022 or 2023 this is not important. When it is, Tesla most likely will be first.

A fully connected car that is always getting better

Now that you have a smartphone, imagine that you would need to change back to a Nokia 3310, or any other dumb-phone. When you are used to having a fully connected car it would feel about the same to switch to one that is not.

Not only is it evident that cars should be connected to the internet by 2020, it also allows the vehicle to be updated. For each update, the car gets better.

Our Tesla, which we bought in August, now has a better range than when we got it, thanks to a free update. The car now has Netflix, YouTube, Spotify, several games, dog mode (which keeps the car cool on hot days), caraoke (karaoke in the car), better windscreen wipers and much more. Everything has come via free updates, just like for a smartphone.

All these games, Netflix and YouTube, does it matter? Right now it is just a fun bonus for 15 minutes when you charge the car. In a few years, this is what you will do when the car drives itself. Not a decisive factor, but it doesn't hurt to be in the lead there also.

Tesla leads in all three areas that are the future of the automotive industry.

They are number one in the transition to electric vehicles, number one in self-driving, and in first place when it comes to a new business model, transport-as-a-service.

When you put Tesla on the weighing machine, that's what you get. There is a long-term substance behind the hyped share price.

VW boss: We will try to catch up with Tesla

I may be wrong, but Volkswagen CEO Herbert Diess seems to agree. In Davos, he was asked why investors buy shares in a company that doesn't even make money, instead of, for example, Volkswagen.

“The stock exchange is about the future, about expectations. Tesla has a product that describes the future of the automotive industry. Tesla leads the way… But we are optimistic that we can keep the same pace and hopefully take the lead in the future…”

On another occasion he recently said that “ if we continue at the same pace as now, it will be very tough. The era for the classic carmakers is over. "

He also warned of VW becoming the next Nokia:

"In summary, this is probably the most difficult challenge Volkswagen has ever faced."

Understanding converging technologies and exponential growth

Tesla vs. the rest of the automotive industry shows the difference between understanding technology development, how different technologies blend converges and what that makes possible.

GM sponsored the winning car in DARPA's competition for self-driving vehicles, but then did nothing at all. In his book, Autonomy, GM's development manager describes how GM, as a hardware company, looked at self-driving as science fiction, despite its win. Instead, it was Google, a software company, that saw the potential and took the lead. Before Elon Musk started building rockets and cars, he came from the internet and software business.

2008-2009 was not just the start of the self-driving revolution when Google presented its project, now called Waymo. In 2008 came Tesla's first car, Roadster and in 2009 Uber was launched.

Last fall, in another WIP analysis, I wrote:

None of these three major innovations - self-driving, electricity and transportation-as-a-service - came from any of the major car companies.

The world's most valuable knowledge

The value of understanding how technology progresses, how technologies converge, what opportunities that create and how society changes, is hard to overstate.

It does not give you the ability to predict the future accurately, it is too complex for that. But it gives you the ability to understand before everyone else what opportunities lie ahead.

If you want to impact the future of humanity, I cannot imagine any more valuable knowledge than that.

This is a premium article, part of our content for Premium Supporters, open for everyone thanks to the members' generous contributions.

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.