💡 Optimist's Edge: Media headlines on bitcoin are wrong – again

The media has portrayed Bitcoin as an environmental disaster. But in this article, we will tell you why it might be more energy-efficient than alternatives.

Share this story!

Summary

📉 What media are wrong about

A report that got international press in 2018 claimed that bitcoin could warm the earth by a full 2 degrees Celsius. Elon Musk tweeted that due to the energy demand created by bitcoin mining, Tesla would stop taking it as payment. These stories are amongst many that use electricity as a reason to discredit innovation around cryptocurrencies.

📈 Here are the facts

Although it is true that bitcoin does consume significant electricity, there are a few key factors to consider on it’s overall impact on the environment.

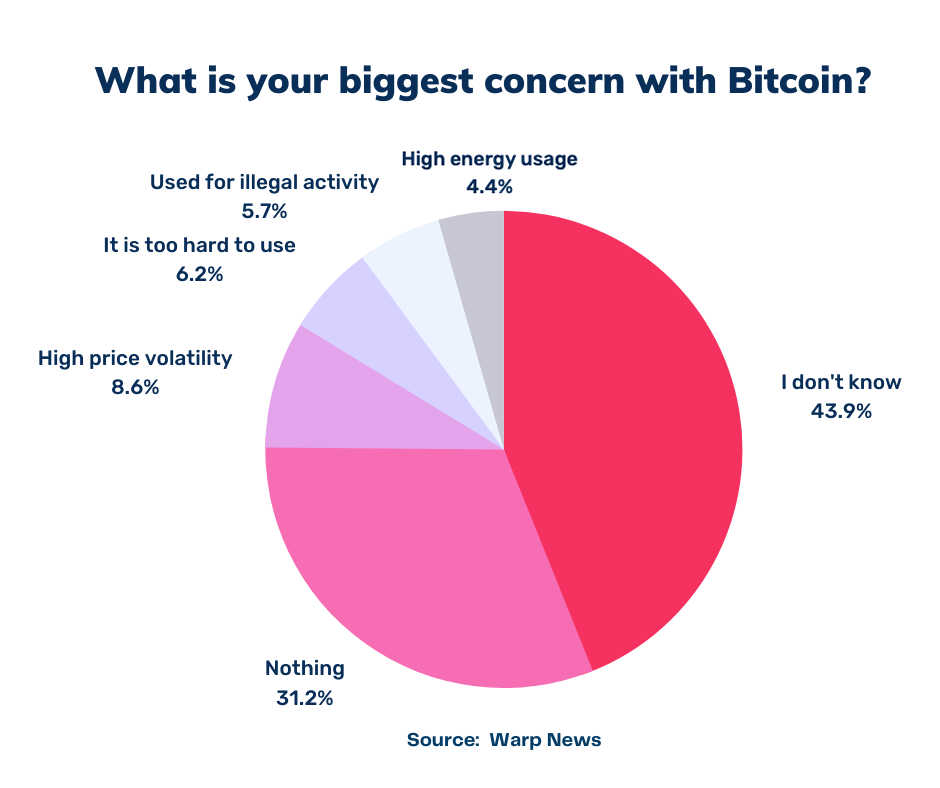

- Only four percent of people surveyed cited energy as a concern they had for bitcoin.

- It is estimated between 39-73 percent, depending on source, of bitcoin mining is from carbon neutral sources. As a reference, the US energy grid is roughly 20 percent carbon neutral.

- Bitcoin mining utilizes energy, but using bitcoin transactions on the network does not contribute to significant additional energy consumption, making it scalable without impact.

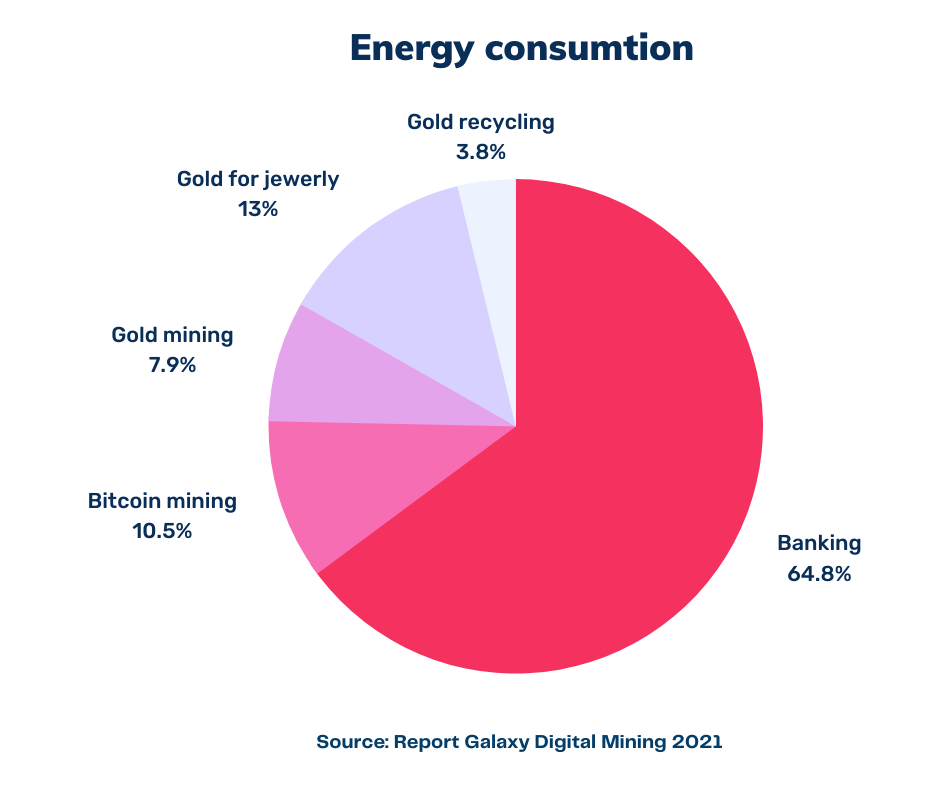

- Most estimates show bitcoin uses approximately half the energy used to mine gold, or the energy that is used for recycling efforts.

💡 Optimist’s Edge

Cryptocurrencies are still in their infancy in utilization and innovation. Still, they are quickly being adopted for remittance due to the speed and significantly reduced costs for transactions. Using bitcoin does not contribute to a significant use of energy and most mining in the future will leverage green sources, such as flared natural gas and hydropower. Bitcoin is well-positioned to reach mainstream adoption.

👇 How to get the Optimist’s Edge

Consider putting a small amount of savings into bitcoin each month. If you need to make international payments or if you have family that you send money to in other nations, look into cryptocurrency networks to reduce costs by as much as 95%.

📉 What media are wrong about

A report that got international press in 2018 claimed that bitcoin could warm the earth by a full 2 degrees Celsius. That story is amongst many that use energy as a reason to discredit innovation around cryptocurrencies. But the utilization of electricity and its carbon emissions are separate concerns. Additionally, the alternatives to cryptocurrency are also energy users, and that should be a factor.

📈 Here are the facts

Bitcoin does consume a lot of energy, which could be a problem without considering many other factors. Additionally, our survey respondents did not see the problem in nearly the same way as the media portrays it; 31 percent chose the alternative that "nothing" worries them about bitcoin. Only 4.4 percent responded that high energy usage was their biggest concern.

Bitcoin and other cryptocurrencies that use the same processing do use a good amount of electricity. Most estimates as of early 2021 show that bitcoin mining consumes approximately 110 terawatt hours per year, and is most commonly compared with the Netherlands or Sweden which consumes about the same amount.

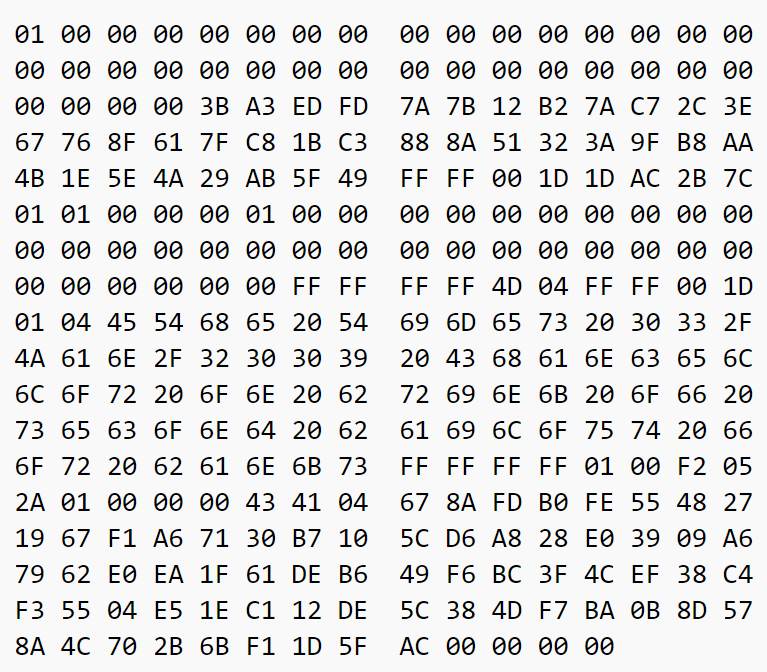

Bitcoin uses electricity in order to verify and record transactions using a process called "proof of work". This process, known as mining, is done by computers who compete for bitcoin rewards through solving very complex math puzzles. This process uses advanced computer processors and, in turn, requires energy to run. The system makes it possible to run these networks without the need of centralized entities, such as a bank, to confirm a payment or another transaction on the network.

Bitcoin, and decentralized networks that operate on proof of work, also must be compared with the global networks they are most commonly compared to outside of electricity consumption contexts. Most commonly, people compare bitcoin with gold, and the bitcoin network with banking.

According to a report by Galaxy Digital, gold is estimated to use approximately 238 terawatt-hours per year of energy across mining, recycling, and processing for items such as jewelry, while the banking industry, through usage of in-person branches and ATM’s, uses approximately 263 terawatt-hours per year.

Although it’s hard to make a direct comparison due to the significantly higher usage of the banking system than the bitcoin system, it’s important to note that the energy use alone does not consider the overall environmental impact with those activities. Most currencies are cotton based papers, and the making of those papers consumes a significant amount of water and contributes to deforestation. Gold mining is considered one of the more destructive processes to the environment in addition to the human cost.

Also, of note with both, and many other comparators, the more they are used the more energy is consumed. With bitcoin, transactions do not correlate with energy consumption – in other words, more utilization (transactions) does not mean more mining, where the majority of energy comes from.

💡 Optimist’s Edge

The future holds a lot of potential for reducing the carbon footprint of bitcoin mining as well. Bitcoin can be mined from anywhere in the world, making it possible to capture electricity sources from areas where there is a lot of waste. One such example is flared natural gas. This energy is a byproduct of oil extraction and typically goes wasted and becomes a pollutant. Most estimates show there is enough of this gas in North America alone to power the entire bitcoin network.

Hydro power is an additional source of energy for bitcoin mining. In many parts of the world, rainy seasons can provide significant energy to bitcoin mining operations that would otherwise go to waste.

These are just two examples of how bitcoin mining will continue to get greener with many others in use and being considered.

The utility of bitcoin is a main factor in determining how efficient the use of the energy is. Understanding that the majority of mining activities will be based on renewable energy over the next few years, even by more conservative estimates, will help you see the possibilities presented by cryptocurrencies. Consider this, the average cost of remittance payments, those earned in one country to send to another, typically to support family or otherwise, is at 6.8% worldwide. Cryptocurrency networks can reduce that cost to under 1% with large transactions.

In a scenario like that, the real question isn’t how much energy is being consumed, the question is if the overall efficiency of leveraging the network is greater than the alternatives. As of today, the answer based on the facts appears to be yes!

👇 How to get the Optimist’s Edge

There are many areas that can be disrupted due to the growth of bitcoin and other cryptocurrencies. Consider putting a small amount of savings into bitcoin each month. If you need to make international payments or have family that you send money to in other nations, look into cryptocurrency networks as a first option and consider opportunities to work with banks and other institutions that are leveraging cryptocurrency networks to reduce your costs.

There are opportunities in investing in startups, or bitcoin mining companies, that operate in nations that produce more energy than they consume, for future growth.

As bitcoin is still a new and volatile in price asset, please always take consideration with investing!

❓ Share your thoughts with us in the Warp News Premium Supporter Facebook group!

Note that this article does not constitute financial advice.

The survey mentioned in the article was done through Google Surveys on 500 respondents.

By becoming a premium supporter, you help in the creation and sharing of fact-based optimistic news all over the world.